by Nicholas Donato | Feb 26, 2021 | Asset Management, Fund of Funds, Private Equity

Now that one in five venture capital exits goes to private equity, the industry has a golden chance to tap the ballooning VC-to-PE deal pipeline for exclusive referrals . By October of last year, private equity sealed more than 800 deals from this emerging channel,...

by Cindy Cao | Apr 13, 2020 | Asset Management, Fund of Funds, Mezzanine, Private Equity, Venture Capital

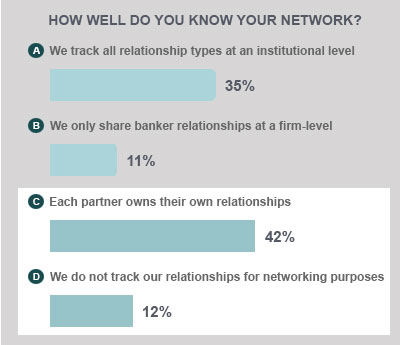

More than 50% of private equity firms do not leverage their own network that can help them source off-market deals, according to a survey that was part of Navatar’s roundtable hosted with ACG. Most firms struggle with institutionalizing their relationship data (as...

by Nicholas Donato | Jul 8, 2019 | Fund of Funds, Private Equity

Private equity firms are hiring more business development specialists. A recent Navatar poll discovered that four out of five firms are at least considering hiring a business development head, while around half already have a dedicated deal originator in place. What’s...

by Nicholas Donato | Mar 6, 2018 | Asset Management, Fund of Funds, Hedge Fund, Mezzanine, Placement Agent, Private Equity, Private Equity Real Estate, Venture Capital

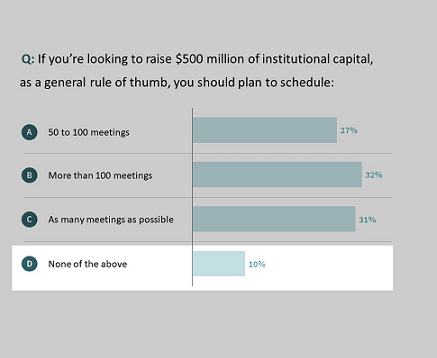

The path to institutional capital can seem murky at best. With few clear guidelines – and few straightforward success stories – a number of common misconceptions about the fundraising process persist in the market. These notions were revealed in a recent...

by Nicholas Donato | Oct 6, 2016 | Asset Management, Fund of Funds, Hedge Fund, Mezzanine, Private Equity, Private Equity Real Estate, Venture Capital

Even four years on from Dodd-Frank pushing most of the industry under the SEC’s spotlight in 2012, private fund managers still have plenty of questions about what it takes to clear the exam process. The SEC has developed a deeper understanding of the industry’s...

by Nicholas Donato | Jun 14, 2016 | Asset Management, Corporate Dev., Fund of Funds, M&A, Private Equity, Private Equity Real Estate

You would be forgiven for believing that most private equity deals are sourced independently given the amount of time fund managers spend describing their “proprietary deal flow”, a persistent industry catchphrase. In fact, it is intermediaries that are the biggest...